Globaltraded.com — The M&A landscape in the Asia-Pacific region has evolved significantly between 2019 and June 2024, with Southeast Asia emerging as a key player in cross-border deals. From 2022, the region experienced a 3% increase in such transactions, particularly in the Financials, Materials, and Real Estate sectors. Wiljadi Tan, Founder and Managing Partner of Protemus Capital, explains, “This growth is a direct result of regional economic integration and ambitious market expansion strategies. Companies are increasingly pursuing inorganic growth to offset the sluggishness in organic growth.”

M&A Trends and Developments

The first half of 2024 showed a continuation of this upward trend in deal volume across Southeast Asia, though the total value of deals saw a 25% decline, amounting to USD 176.37 billion. This reduction, as Tan notes, “was largely driven by ongoing geopolitical and economic uncertainties carried over from 2023. With several general elections in APAC, firms became more cautious, opting for smaller, less risky acquisitions.”

As the second half of 2024 unfolds, Wiljadi Tan anticipates a resurgence in M&A activities, particularly in Southeast Asia, where new political leadership and stabilizing interest rates could restore confidence. “We’re likely to see a return to larger-scale deals as economic conditions improve,” Wiljadi Tan, a senior M&A advisor who previously worked at RSM and Grant Thornton, predicts.

Country-Specific Highlights

China, despite a downturn from its 2020 peak, remained a leader in the APAC M&A market in 2024. Tan points out that “China’s challenges, including political structural issues, deflation, and a real estate crisis, have dampened its M&A momentum, but it still holds a dominant position in the region.”

Australia, on the other hand, experienced a significant slowdown in M&A activity during the first half of 2024, particularly in the Consumer Discretionary sector. Rising living costs and business expenses were key factors, leading to what Tan describes as “a normalization process after several years of heightened activity.”

Japan, however, continues to attract considerable interest, particularly from private equity firms. Tan observes, “Japan’s favorable regulations and rising shareholder activism make it a hotbed for investment. Additionally, the country’s demographic challenges are pushing Japanese companies to seek opportunities abroad, further fueling outbound M&A activity.”

Sectoral Insights

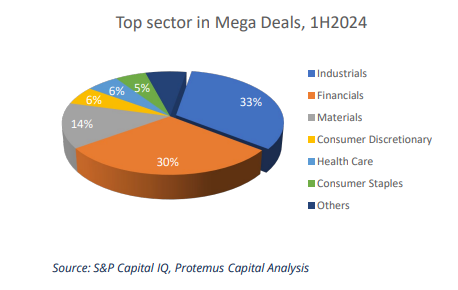

Industrials, Financials, and Materials have historically led M&A activities in the Asia-Pacific, and the first half of 2024 was no exception. “The Industrials sector, in particular, has been the cornerstone of M&A transactions in the region,” notes Tan. “This trend reflects the consistent demand for infrastructure development and industrial growth across APAC.”

The Financials sector also played a pivotal role, despite experiencing a slight downturn in 2023 compared to previous years. However, Investment Banking and Brokerage deals surged in the first half of 2024, with this segment surpassing previous years’ figures in deal value. “The shift towards smaller but more frequent transactions indicates a more measured approach to M&A in the financial sector,” Wiljadi Tan adds.

Real Estate has seen a remarkable 17% increase in value in the first half of 2024, driven by strong demand for residential, industrial, and logistics properties. “The post-pandemic rebound in the real estate sector is a clear sign of investor confidence,” Tan states. “Urbanization, e-commerce growth, and infrastructure development are all contributing factors.”

The Role of ESG in M&A

Environmental, Social, and Governance (ESG) considerations are increasingly shaping M&A activity in the region. Tan remarks, “Sustainable projects are becoming a priority for investors, particularly in sectors like Real Estate and Industrials, where the environmental impact is more pronounced. Cross-border investments are also on the rise as foreign capital seeks attractive opportunities in these thriving markets.”

Technology and Innovation

The Information Technology (IT) sector has demonstrated remarkable consistency in M&A activity. Although the total deal value in the first half of 2024 decreased from USD 18.21 billion in 2023 to USD 14.88 billion, the number of deals actually increased by 5%. Tan attributes this to “a shift towards smaller transactions, which reflects sustained interest in IT investments, albeit on a more cautious scale. The region is on the brink of explosive growth in data consumption and digital services, driving demand for investments in data centers, fiber networks, and communication towers.”

Looking Forward

The Asia-Pacific M&A landscape is poised for further transformation in the latter half of 2024. The Industrials sector, which has been a driving force in the region’s M&A activities, is expected to maintain its momentum, with first-half deal values staying on pace with previous years. Tan highlights the importance of Electrical Components and Equipment in 2024, with notable mega deals like the one involving Anhui Anfu Energy Technology. “This sector’s consistent performance underscores its critical role in APAC’s industrial growth,” Wiljadi Tan says.

In the Telecommunications sector, which saw significant consolidation and expansion during the pandemic years of 2020 and 2021, the trend has shifted towards smaller, more strategic deals. “The stabilization of this sector reflects the maturation of the market after the explosive growth driven by the global shift towards digital and remote communications,” Wiljadi concludes.

Asia-Pacific M&A landscape will remains dynamic, offering both challenges and opportunities. The region’s economic resilience, coupled with strategic sectoral shifts, will likely shape the trajectory of M&A activities in the years to come.